New York is making moves to tackle one of the biggest hurdles in the cannabis industry—banking access. The state’s Office of Cannabis Management (OCM) has launched the Cannabis Banking Directory, a resource designed to connect licensed cannabis businesses with financial institutions that are open to working with the industry.

For too long, cannabis operators have struggled to find reliable banking partners due to federal banking restrictions. With this new directory, OCM aims to remove those barriers and help licensed businesses gain access to essential financial services.

A Game-Changer for NY’s Cannabis Industry

The Cannabis Banking Directory is a direct response to the ongoing banking challenges cannabis businesses face. While New York has worked to establish an equitable cannabis market, access to financial services has remained a roadblock for many operators.

This initiative, launched by OCM’s Social and Economic Equity (SEE) team, is a step toward creating financial stability for cannabis businesses. The directory will be regularly updated to ensure businesses have access to the most up-to-date banking resources.

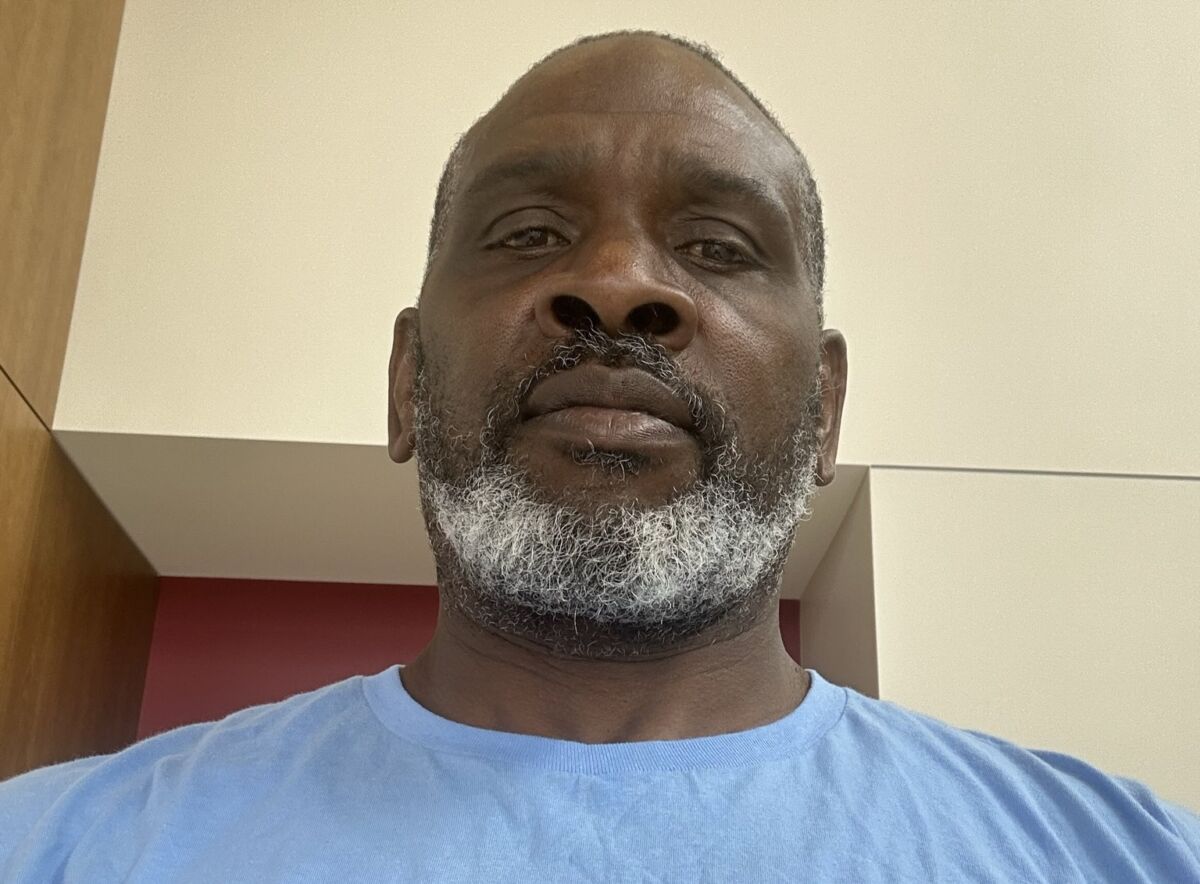

Felicia A.B. Reid, OCM’s acting executive director, emphasized the importance of this initiative:

“New York’s legal cannabis market cannot thrive without access to reliable financial services. At OCM, we are committed to fostering a fair, transparent, and sustainable market, and this initiative is a key part of that effort.”

Why Banking Access Matters for Cannabis Businesses

Despite cannabis being legal in New York, many banks and credit unions remain hesitant to work with the industry due to federal regulations and the high compliance costs associated with serving cannabis-related businesses. This forces many operators to run on a cash-only basis, which can lead to security risks, limited growth opportunities, and financial instability.

With over 305 adult-use cannabis dispensaries now operating across New York—including eight in Rochester and others in surrounding counties—the need for accessible financial services is more crucial than ever. In 2024 alone, the state’s cannabis market generated over $1 billion in sales, highlighting the economic impact of the industry.

How the Cannabis Banking Directory Helps Operators

The Cannabis Banking Directory serves as a centralized hub for cannabis operators looking for financial services. Here’s what businesses can expect:

- A regularly updated list of banks and credit unions that accept cannabis businesses.

- Increased transparency about which financial institutions are open to serving the industry.

- Reduced barriers to obtaining essential services such as business accounts, payroll processing, and loans.

For businesses struggling to secure financial partners, this resource provides a critical lifeline to ensure they can operate safely and efficiently.

How Banks and Credit Unions Can Get Involved

Financial institutions that are interested in being included in the Cannabis Banking Directory can email the SEE team at SEE@ocm.ny.gov to join the list. By participating, banks and credit unions can tap into New York’s booming cannabis market while supporting the growth of licensed businesses.

The Bigger Picture: Federal Banking Reform Still Needed

While the Cannabis Banking Directory is a major win for New York’s cannabis businesses, the industry still faces federal banking restrictions that create obstacles for operators nationwide. Many are hoping for the passage of the SAFE Banking Act, which would provide long-term financial solutions and reduce risks for both cannabis businesses and financial institutions.

For now, New York’s initiative sets an important precedent, showing how state-level action can make a difference in improving financial access for the cannabis industry.

Final Thoughts

New York’s launch of the Cannabis Banking Directory is a significant step toward building a more sustainable and transparent cannabis market. By connecting licensed businesses with banks and credit unions willing to serve them, OCM is helping to reduce financial barriers, enhance security, and promote economic growth within the industry.

As the cannabis market continues to evolve, initiatives like this will be essential in paving the way for a fully functional and equitable industry.

Want to stay updated on the latest in cannabis business and culture?

Black Cannabis Magazine is your go-to platform for cannabis culture, news, and lifestyle content with a focus on diversity and inclusion. For more information, visit www.blackcannabismagazine.com.

Copyright 2025 Black Cannabis Magazine. Distributed by Hazey Taughtme, LLC.