Introduction: Pennsylvania Marijuana Legislation on the Horizon

The state of Pennsylvania may be on the brink of significant changes to its marijuana laws, as lawmakers consider a bill that could transform the landscape of cannabis regulation. The proposal aims to legalize recreational marijuana and sell it through the state liquor store system, a move that has been met with both support and skepticism. This article delves into the potential impact of the proposed legislation, including its benefits, drawbacks, and implications for the state’s economy.

A New Era for Recreational Marijuana

The proposed legislation would pave the way for Pennsylvanians to purchase recreational marijuana alongside alcoholic beverages at the same store. This shift has the potential to simplify access to legal cannabis, removing the need for separate dispensaries and streamlining the process for consumers. Additionally, the bill would expunge low-level cannabis convictions, providing relief for individuals with minor offenses on their records. Finally, the legislation would allow residents to grow up to six marijuana plants, granting them the freedom to cultivate their cannabis at home.

The Benefits: Taxing and Regulating Cannabis

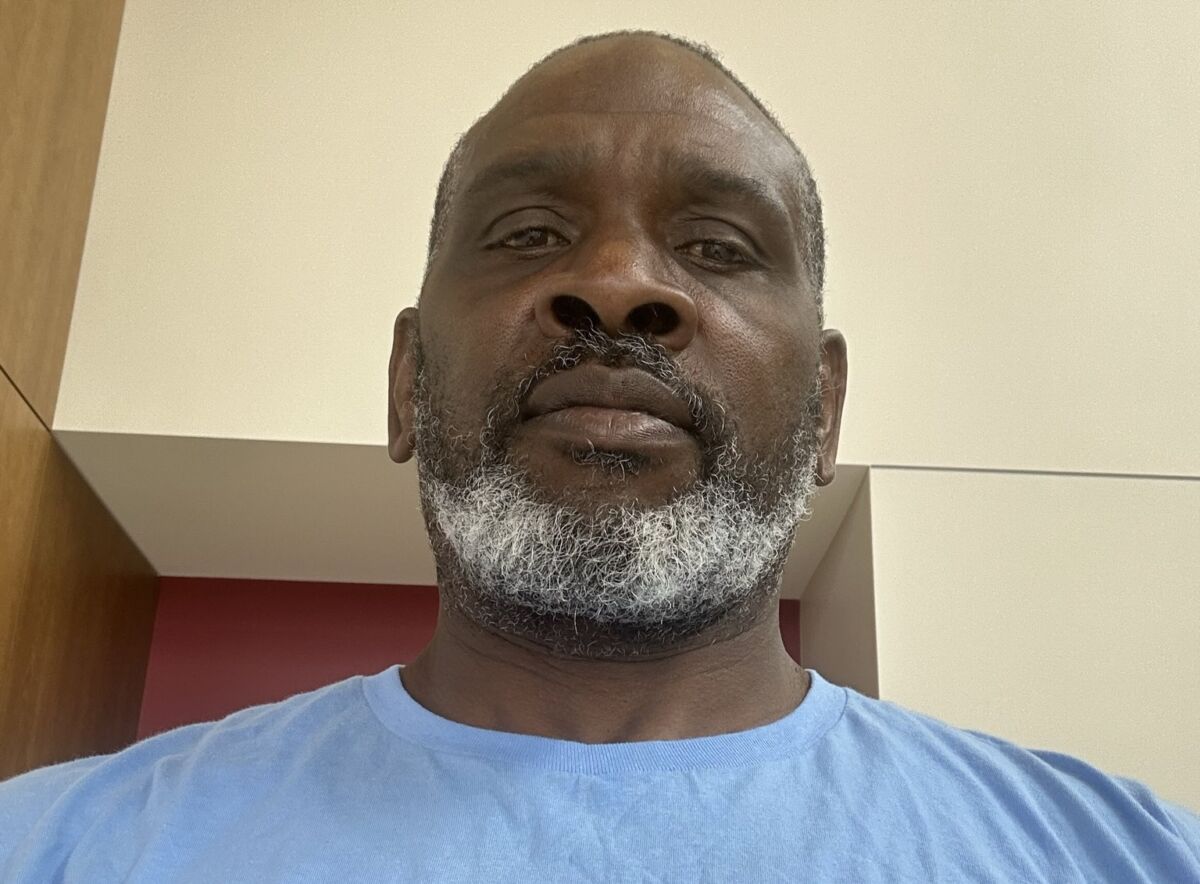

Sen. Dan Laughlin, a supporter of the bill, believes that legalizing and taxing recreational marijuana would be a beneficial move for Pennsylvania. According to Sen. Laughlin, those who wish to use cannabis in the state are already doing so, and the legislation would allow for regulation and the creation of a safe environment for purchasing cannabis products. By imposing a tax on marijuana, Pennsylvania could generate additional revenue that could be allocated to various state programs and initiatives.

The Concerns: State Liquor System Control and Research

Despite his support for legalizing and taxing recreational marijuana, Sen. Laughlin expresses reservations about the proposed control of marijuana sales through the state liquor system. He argues that the state should not be involved in selling either liquor or cannabis and that including this provision could hinder the passage of the bill.

Similarly, Rep. Jake Banta emphasizes the need for more information and research on the experiences of other states before making a decision on the proposal. He believes that a comprehensive study would provide valuable insights and guidance for Pennsylvania lawmakers as they weigh the potential advantages and disadvantages of the legislation.

Governor Josh Shapiro’s 2023-2024 Budget Proposal

Governor Josh Shapiro is also pushing for the legalization and taxation of recreational marijuana in his proposed 2023-

2024 budget. By including this initiative, Governor Shapiro signals his support for the potential benefits of marijuana legalization, such as increased revenue and a more regulated market.

The Potential Economic Impact: $188 Million in Annual Revenue

If the proposed legislation is approved, it is estimated that the legalization and taxation of recreational marijuana could generate an impressive $188 million in annual revenue for Pennsylvania by 2028. This additional income could be used to fund various state programs, from education to infrastructure, providing a significant boost to the local economy.