In a momentous stride toward eliminating financial barriers for legal cannabis businesses, the Senate Banking Committee greenlit the Secure and Fair Enforcement Regulation (SAFER) Banking Act Wednesday. The bill, sponsored by Senators Jeff Merkley (D-OR) and Steve Daines (R-MT), successfully navigated through the panel with a 14-9 vote. This watershed decision follows a string of revisions aimed at consolidating bipartisan support, setting the stage for broader conversations surrounding cannabis reform.

Bipartisan Consensus Amid Controversy

Committee Chairman Sherrod Brown (D-OH) conveyed the imperative nature of the legislation, emphasizing its necessity to ensure safer operations for legal cannabis businesses. Meanwhile, Senator Daines clarified that his support is not an endorsement for cannabis legalization but a means to curb the vulnerabilities faced by cash-only cannabis enterprises.

Unresolved Amendments: A Mixed Bag

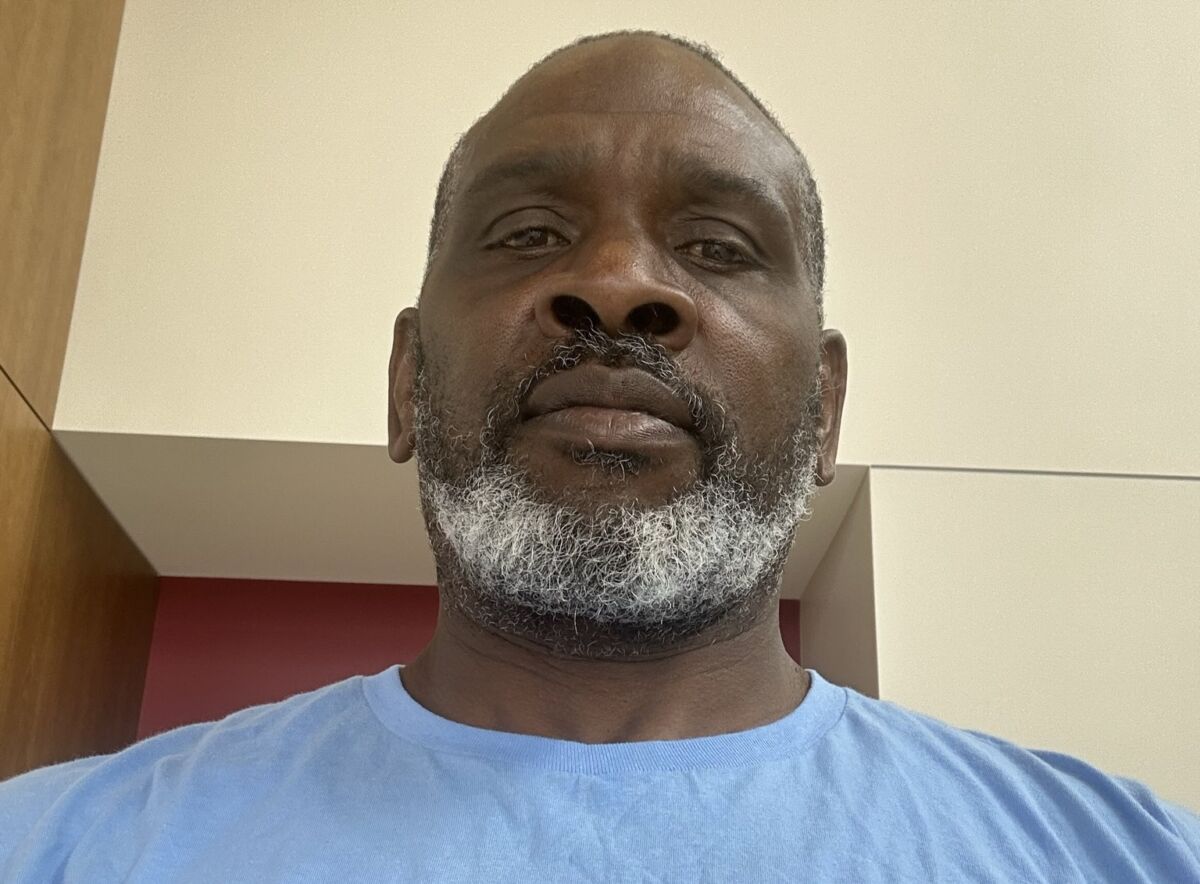

While the committee adopted non-controversial amendments for technical refinements, it opted not to consider more sweeping proposals. These included amendments targeting access to stock exchanges and justice-focused marijuana reform. Notably, Senator Raphael Warnock (D-GA) pushed for a sunset clause, which was ultimately rejected. This proviso would have terminated the Act in five years unless it demonstrably narrowed the racial wealth gap and mitigated other negative economic impacts of the War on Drugs.

Broader Concerns Voiced

Senator Elizabeth Warren (D-MA) aligned with Senator Warnock’s reservations but maintained her support for the bill, citing its alignment with “common sense policy.” Both senators advocated for more comprehensive cannabis reforms that address the implications on communities disproportionately impacted by cannabis criminalization.

The Road Ahead: Complex but Promising

Despite prior hurdles, Senate Majority Leader Chuck Schumer (D-NY) plans to introduce amendments focusing on state-level cannabis expungements and gun rights for cannabis consumers. It’s a signal that while the bill is likely not in its final form, a more comprehensive approach is on the horizon.

How Safer Affects Communities of Color

The SAFER Banking Act stands to be particularly impactful for communities of color, largely due to its implications for business ownership and economic mobility within the legal cannabis landscape. Here’s why:

- Access to Capital: Traditional banking services have often been difficult to secure for businesses within communities of color. The Act would allow legal cannabis businesses, including those owned by people of color, to access banking services freely. This is key to securing loans, improving business infrastructure, and expanding operations.

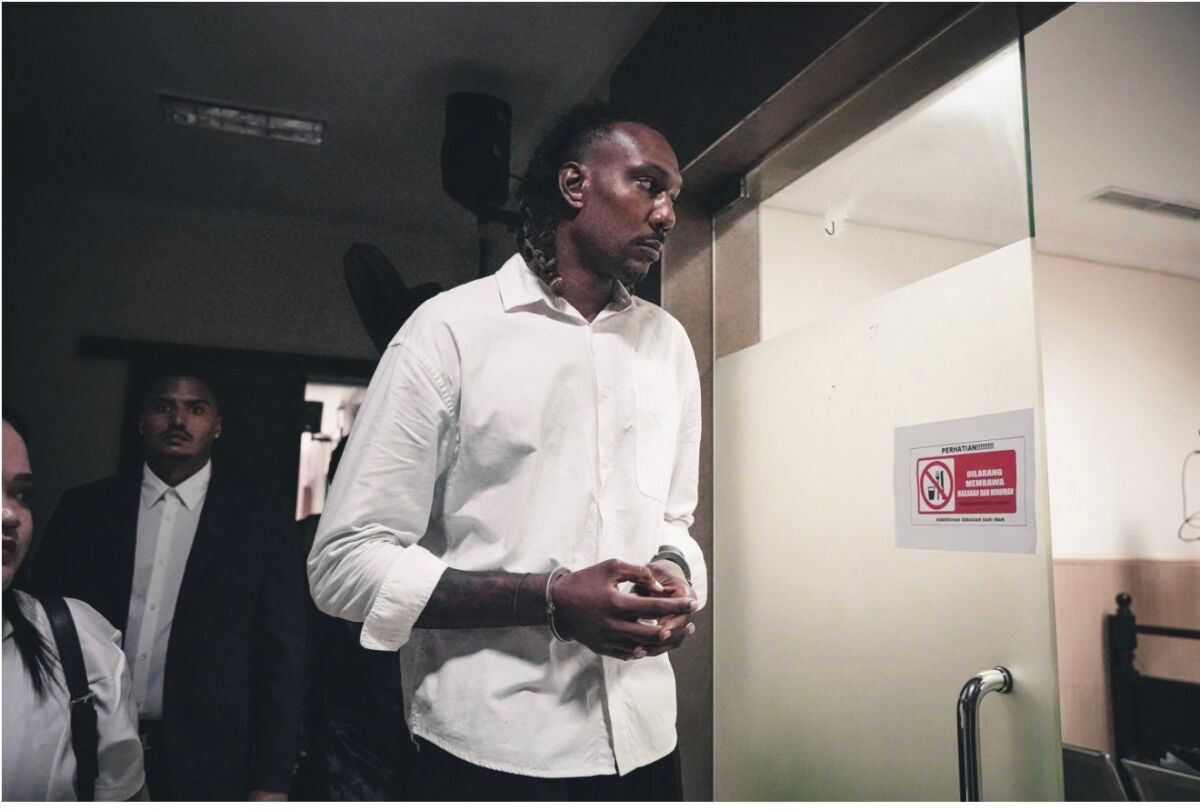

- Safety and Security: Operating in cash heightens the risk of robbery and violence, a burden often disproportionately shouldered by communities of color. Formal banking offers enhanced safety.

- Regulatory Compliance: With proper access to banking, businesses can more easily comply with regulatory requirements, which may otherwise be cumbersome and complicated when dealing in an all-cash model. Easier compliance levels the playing field.

- Transparency and Legitimacy: The Act adds a layer of financial transparency that can bolster the legitimacy of businesses, making them more appealing to consumers and investors alike. This is crucial for businesses in marginalized communities to build trust and secure investment.

- Wealth Building and Reinvestment: Easier banking can accelerate profit generation and savings, which can be reinvested into the community. This will help in narrowing the racial wealth gap over time.

- Intersection with Social Justice Goals: While the Act doesn’t directly tackle social justice issues, its passage may make it easier to address these concerns in future legislation. For instance, having the financial flexibility and safety provided by formal banking can be key to launching social programs or initiatives aimed at restorative justice.

- Lowering Barriers to Entry: By making the financial aspects of running a cannabis business less onerous, the Act could lower the barriers to entry for aspiring entrepreneurs from minority backgrounds.

So, while the SAFER Banking Act isn’t a comprehensive solution to the myriad challenges faced by communities of color in the cannabis industry, it represents a meaningful step forward.

Industry Advocacy Continues

A host of industry groups and trade associations, including the American Trade Association for Cannabis and Hemp (ATACH), have urged quick passage of the SAFER Banking Act, citing both financial risks and the “humanitarian toll” of robberies against cash-intensive cannabis businesses.

Conclusion: A Seminal Step, Yet Much Work Remains

While the SAFER Banking Act’s progress marks an important juncture, its path is fraught with complexities requiring deft navigation. The bill’s evolution will undoubtedly influence not only the financial but also the ethical landscape surrounding cannabis, especially within communities that have been disproportionately impacted by decades of cannabis prohibition.