The cannabis industry is evolving rapidly, and urban cannabis brands are exploring new territories. At the CHAMPS Trade Show in Las Vegas, the largest B2B expo for the counterculture industry, we saw firsthand how brands are expanding beyond cannabis into hemp, THCA, and even tobacco.

CHAMPS Trade Show: A Hub for Industry Innovation

The CHAMPS Trade Show, held from July 23-26 at the Las Vegas Convention Center, featured over 50,000 square feet of booths and exhibits. This event has been a cornerstone of the counterculture industry since 1999, connecting buyers and sellers to promote market growth. This year’s Las Vegas show was packed with exciting innovations from brands pushing the envelope in smokable products.

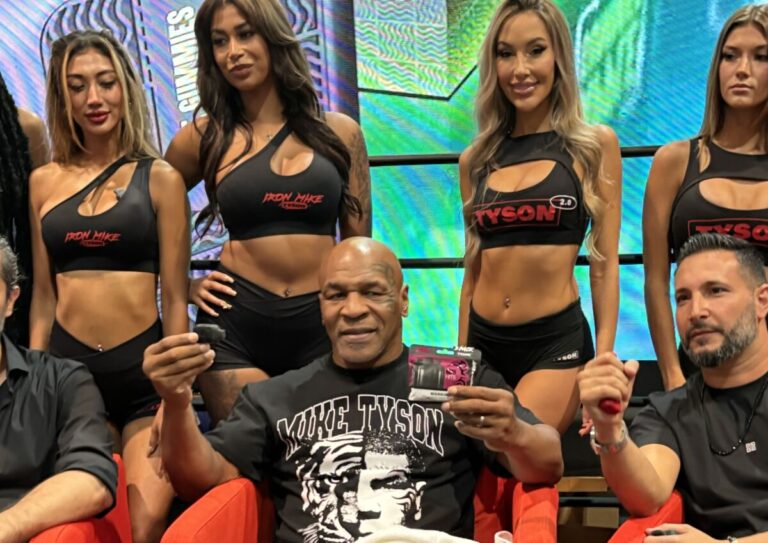

Among the brands making waves were Cookies, Gashouse/Backwoods, Ball Family Farms, Big Chief, Tyson 2.0, Heights, Backpackboyz, El Blunto, Runtz/Jokes Up/Kream, Soft Srrve, Players Only, and Gumbo. These brands, already well-known in cannabis culture, are broadening their portfolios into new smokable alternatives, seizing on opportunities beyond the traditional cannabis market.

The THCA Loophole: A Rapid Expansion

One of the hottest trends right now is THCA flower. THCA is the non-psychoactive form of THC found in raw cannabis, but when heated or burned, it converts into THC, which is psychoactive. THCA flowers are being sold legally in states where cannabis remains prohibited, making it a highly attractive option. THCA products can now be found in smoke shops, gas stations, and even delivered straight to consumers. Brands are taking advantage of this legal gray area to reach consumers in states where cannabis is still illegal.

For Marquin Chandler, founder of Soft Srrve, THCA presents an opportunity to legally reach consumers across state lines:

“My biggest motivation was being able to get my products to the other states legally. I get a lot of DMs from customers around the states that I can’t fulfill. With understanding my products, I was able to duplicate each product with minimal drop-off in quality. I’ve been working with THCA and other concentrates for so long that it was a pretty easy transition for me. Long term, I can continue adapting to the ever-changing regulations from state to state. The good thing that I have going for me is I understand products. Me being an MSO from the legacy markets, I have a keen understanding of what the consumers like.”

As Texas experiences a surge in smoke shops and dispensaries offering THCA flower, the question remains: how long will this loophole last? Brands are benefiting from it now, but regulatory changes are always looming.

Hemp and Tobacco: Expanding Revenue Streams

Urban cannabis brands are also expanding into hemp and tobacco. Hemp, being federally legal, offers these brands a low-risk option to diversify their product lines, from CBD oils to smokable hemp flower.

Stiiizy, a dominant cannabis brand, has even pivoted into tobacco with their Stiiizy Leafs product line, and Runtz Wraps, a tobacco leaf product from the founders of Runtz, is rumored to be part of a multi-million dollar acquisition by Zig Zag. These moves are evidence of how the cannabis and tobacco industries are starting to merge, with afterparties at strip clubs in Las Vegas celebrating potential deals.

Felix Murray, CEO of Gashouse, shared his vision for the future of urban cannabis brands, emphasizing the importance of diversifying into related products:

“I think urban cannabis brands should evolve to expand their portfolios to include more than just cannabis products and should produce or create ancillary products related to the industry as a whole to have a stronger portfolio and stronger business model. Also, being conscious of merchandising products that aren’t affected by the 280e tax code—which is a major tax burden in cannabis—will help your business bottom line. When it comes to things like THCA (currently being outlawed in most states), hemp, as well as ancillary non-cannabis items, there is no 280e tax code to apply, which means the profits are much higher. Brands should be consciously thinking of things they can bring to market that are profitable and staying three steps ahead. It’s a reason we’ve been leading this charge for a decade now; being ahead and innovative is where we shine.”

Felix’s vision for Gashouse is more than just cannabis. He elaborated:

“As CEO, my vision for Gashouse isn’t just cannabis but all lifestyle-related products and merchandise—from water pipes, tobacco leaves, papers, rolling trays, lighters, ashtrays, and everyday things such as clothing, backpacks, and a host of other items. It’s keeping us out of the box, and by having these other products, it allows us to have a presence in every state and be in thousands of storefronts in the country, as well as outside the country in a multitude of businesses (smoke shops, bodegas, gas stations, etc.) with our brand and not just limited to dispensaries, which are still very limited in numbers.”

Opportunities and Challenges in the Smokable Market

Expanding into hemp, THCA, and tobacco offers exciting opportunities but also comes with challenges. Legal complexities are top of mind, particularly with products like THCA, which could face tighter regulation soon. Additionally, brands must market carefully, as the typical cannabis consumer might not instantly warm up to hemp, THCA, or tobacco products.

However, the potential rewards are significant. THCA allows brands to enter markets where cannabis remains restricted, while hemp offers a versatile, federally legal option. Tobacco, though controversial, still commands a massive consumer base, and its blending with cannabis products could create a hybrid market with wide appeal.

The Future of Cannabis Brands: Diversifying and Innovating

The urban cannabis market is evolving as brands move into hemp, THCA, and tobacco. Stiiizy’s pivot into tobacco and the rumored Zig Zag acquisition of Runtz Wraps highlight how quickly these markets are changing. But these shifts also carry risks, as demonstrated by Stiiizy’s current lawsuit over their hemp products.

Felix Murray’s insight provides a roadmap for the future—urban cannabis brands must remain adaptable, creative, and ready to seize opportunities in both cannabis and ancillary markets. As regulations shift, those who can diversify and stay ahead of trends will be positioned to thrive in the ever-expanding smokable landscape.